Real estate prices soar, owners wait to see what gas development brings

This is a two-part series focusing on the effects of the Marcellus Shale development in the northeastern part of the Commonwealth.

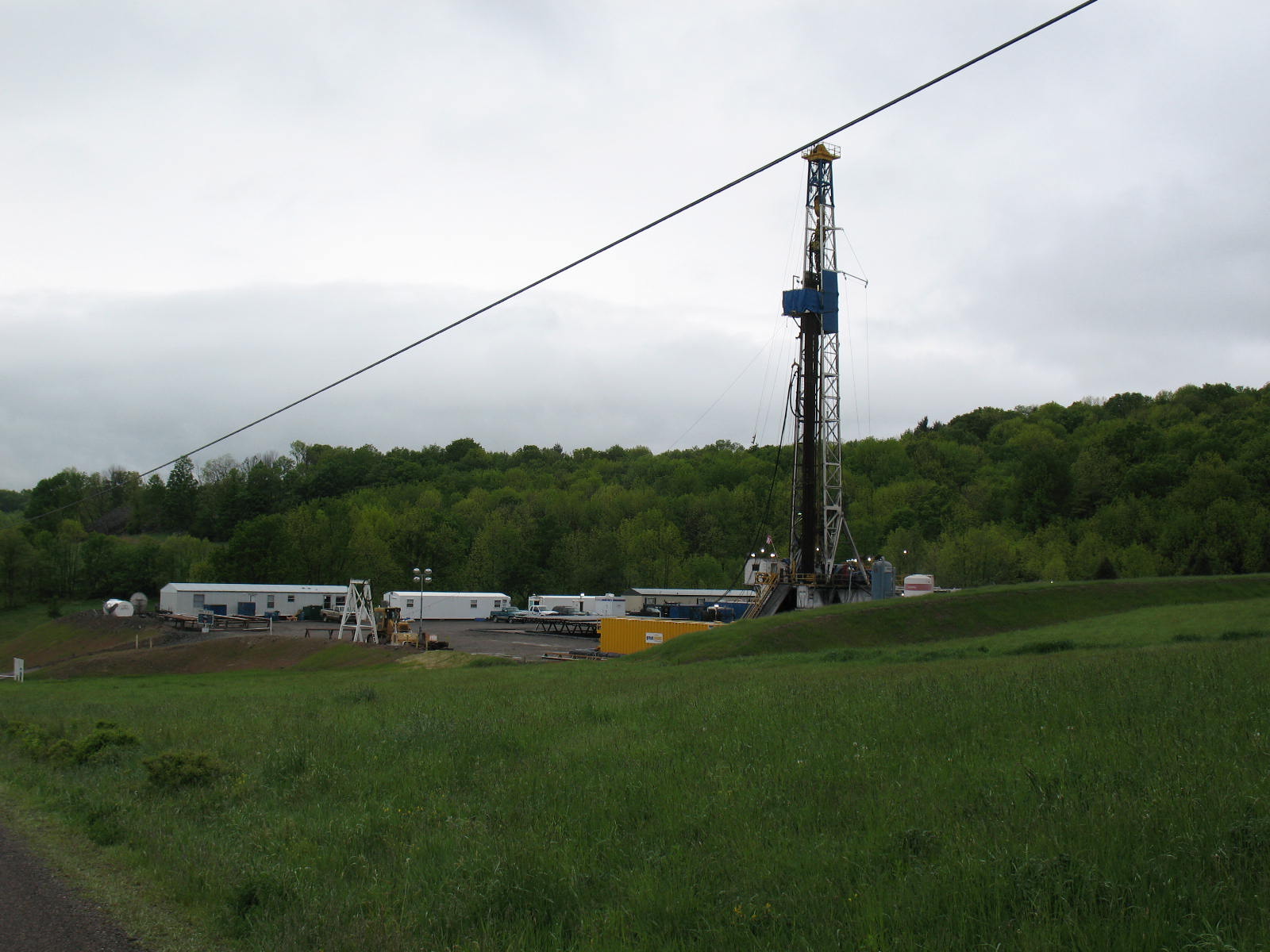

Drilling in the Marcellus Shale regions has real estate prices skyrocketing in northeastern Pennsylvania.

Three years after companies started developing the natural gas in the Marcellus Shale formation in the Commonwealth, Bradford, Sullivan, Tioga, Lycoming, Susquehanna, Wyoming and Clinton counties have seen their real estate markets transformed with the ongoing natural gas development.

“We’ve changed how we’re selling real estate,” said 30-year real estate veteran Bill Them of Century 21 Jackson Real Estate in Wysox, Bradford County. “A house and 10 acres that may have been worth $250,000 is now seeing the potential of generating $30,000 to $180,000 a year in gas royalties. More of the value is in the land and people who own 200 acres in the area stand to become millionaires.”

Bob Wood with The Real Estaters of Mansfield said, “In three years, prices for gas leases went from $10 an acre to $1,500 an acre and as high as $2,500 and even higher recently. Prices continue to fluctuate and the types of leases and the important legal clauses within them have changed over time. More people want to keep their lease rights indefinitely or for a specific period of time. In addition, many are retaining part of the rights and transferring some of the rights to the buyers. We’ve seen a substantial price increase in raw land and in the value of residences with larger lots.”

There’s not much rural real estate for sale in the counties where the Marcellus Shale is being developed, according to Lester Greevy, a Williamsport attorney who specializes in gas and oil rights. “We’re not seeing those 20- to 30-acre farms for sale and if they are, they’re priced at a tremendous price, the likes of which we’ve never seen,” he added.

The Marcellus Shale development has made real estate transactions more complicated, Greevy explained. “Prospective buyers need to understand that not all leases improve the value of the land. Understanding whether the lease is in the best interest of the buyer and/or the seller isn’t always easy,” he said.

In areas of Sullivan and Lycoming counties, Robin Fiester with Robin Real Estate, Eagles Mere, said the gas drilling has created a frustrating situation. “We have fewer sellers who want to sell their acreage or they want to keep the gas rights if they do sell,” she said. “It’s hard because we can’t put a value on the gas rights yet because we don’t have the data to show what it will be worth.”

PAR’s District 1 Vice President Kim Skumanick is seeing many changes in her home town of Tunkhannock. “The problem is, there isn’t land for sale anymore. We have a lot of clients who would buy land and later build a home to retire. Now property owners are holding onto their land, speculating about what might happen. Some of our farmers may have faced difficult times and previously might have sold some of their land. Now they’re selling gas rights to the land,” she said.

Raul Azpiazu, president of the Bradford-Sullivan County Association, said many of the land sales in his area have come to a halt. “We’ve lost 30 to 40 percent of our land listings. Sellers want to keep the subsurface rights; buyers want to have the rights. We’ve tried to become creative, sending them to attorneys who can negotiate a deal with 50 percent of the royalties,” he said.

Wood said the need for more detailed property searches has become a necessity. “Property searches now date back to 1850 because they’re finding some handwritten lease agreements,” Wood said. “The property search fees have doubled or tripled and the sellers and buyers are arguing over who should pay for the search. There’s no end to the extra consequences; we’re seeing every shade of gray in every transaction now.”

PAR Standard Forms Committee has published a Gas and Oil Lease Addendum form to the Agreement of Sale for use in these transactions.

REALTORS® interested in joining PAR’s Google Group on Oil and Gas should contact Brenda Florida.

Topics

Share this post

Member Discussion

Recent Articles

-

Estimated Closing Costs: How Mandatory Are They, Really?

- November 22, 2024

- 5 min. read

When do you have to give estimated costs? Can you use estimated costs developed by others? Let’s hit a couple of common Legal Hotline questions about the details of estimated closing costs.

-

Tri-County Realtor® Leads Efforts to Fight Hunger

- November 21, 2024

- 2 min. read

Heather Griesser-LaPierre, a member of Tri-County Suburban Realtors®, led an initiative last month to pack 238,000 meals for hurricane victims alongside fellow Realtors® and other volunteers.

-

9 Tips to Save Money When Moving

- November 20, 2024

- 3 min. read

For new homeowners, moving costs can add up quickly. Here are nine tips to keep moving costs down, from Point2.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.